PLANNED GIVING

Cultivate your legacy

Why We Give –

Tom Mays and Orlando Zayas

• Members since 1995

• Donors since 2011

• Planned giving donors since 2019

“With the desire to begin shaping our legacy as part of a dynamic cultural institution, came these questions:

-

- How can we make an impact beyond our lifetimes?

- How can we help guarantee the Center’s future and sustainability?

- How can we continue to provide other community members with access to the Center’s botanic garden, arboretum and education resources?

We chose to make a legacy gift that will do just that while serving as a resource during lean and mean times. Our planned gift will help the Wildflower Center to plan and pivot — just as we all have learned to do during the pandemic — so that generations to come may be able to experience the beauty of this 284-acre natural landscape.” – Tom Mays (above left, with Lynda Johnson Robb and Orlando Zayas)

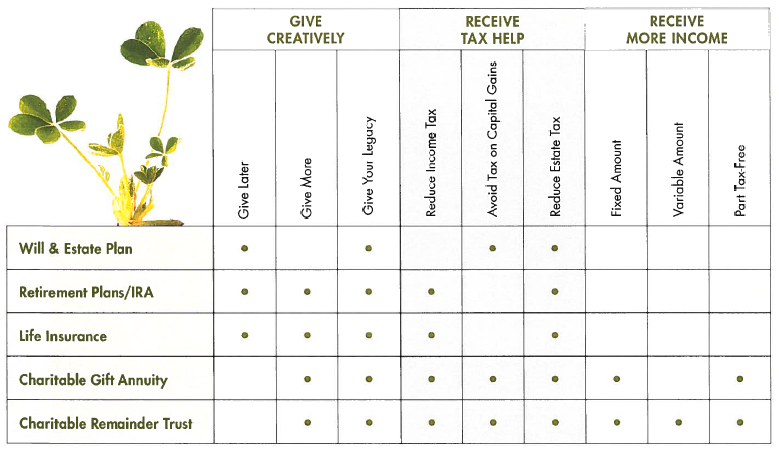

Many Ways to Make a Difference, Many Ways to Give

There are many ways to make a legacy gift — perhaps some you haven’t even considered and many of them offer benefits to you or your family as well as the Wildflower Center. Here are a few types of assets you can give to achieve your goals.

Cash

Giving cash is the simplest way to make a difference for the Wildflower Center. For most donors, a cash gift is tax deductible.

Stocks & Securities

Giving securities, including stocks and bonds, is easy and effective. If you have held appreciated securities for more than a year, giving them to the Center can provide a tax deduction and help avoid capital gains taxes.

Mineral Interests

By transferring mineral rights to the Wildflower Center with the help of the University Lands office, you are truly giving a gift that keeps on giving. University Lands has been stewarding the largest land and minerals endowment in the country for more than 100 years. Our experts will ensure your natural resources yield maximum value, all of which will go toward helping the Center achieve its goals.

Real Estate & Land

A gift of real estate, such as your home, ranch, vacation property, commercial property or even vacant land, can make a big impact on the Center. Moreover, if your property has appreciated, gifting it can provide a tax deduction and help avoid capital gains taxes.

Life Insurance

If you no longer need your life insurance policy, you can list the Center as the beneficiary.

Retirement Plans

Giving the Center part of your retirement assets, such as your IRA, 401(k), 403(b) or other tax-deferred plan, is a simple way to make a gift and avoid taxes or reduce your tax rate. At age 73, you must take a required minimum distribution (RMD) annually. At age 70 ½, you may use the qualified charitable distribution (QCD) option for an IRA gift. Moreover, retirement plans passed to your children and heirs carry a tax-related burden. On the other hand, naming the Center as a retirement plan beneficiary avoids income taxes, and the Center receives the full value of your retirement plan gift.

Will & Estate Plans

You can designate the Center as a beneficiary in your will, living trust or other estate plan document. Inquire about sample language.

Business Interests & Closely Held Stock

Nothing has growth potential like your stake in a growing company. There are key times in the life of a business when it makes sense to set aside some of the ownership interest for charitable contributions, such as:

- When a company is being formed

- Before an initial public offering (IPO)

- When a company is being recapitalized

- Before the sale, merger or acquisition of a company

- Before an owner or partner in a company retires

By donating closely held stock before these liquidity events occur, you can claim an immediate tax deduction for the full market value without ever recognizing a taxable gain. You essentially “double up” on the tax benefits.

Charitable Gift Annuity (CGA)

If you are 55 or better, you can give cash or appreciated securities to the UT Foundation, which works closely with the Wildflower Center. With a charitable gift annuity (CGA), you are paid a fixed amount (with rates based on your age) annually for the rest of your life. This payment stream provides security for you and your loved ones, and some of this income may be tax free. After your lifetime, the remainder in the annuity account benefits the Center.

Charitable Remainder Trust

As with a charitable gift annuity, a charitable remainder trust allows you to transfer cash and appreciated securities as well as property to the UT System or your own bank/trust company. The difference is that instead of a simple annuity contract, your asset funds a trust, which directs a specific distribution to you or your family, with the remainder being distributed to the Center. The trust will provide you with an upfront charitable tax deduction and provide you with income for life (flexible or fixed for life or for a set term of years).

Charitable Lead Trust

You can transfer cash, appreciated securities, and/or property into a lead trust that makes gifts to the Center for a number of years. You will receive a charitable deduction, and you or your family receives the remainder of the trust – a tax-wise way to move an asset to a loved one.

Match Your Gifts to Your Goals

Download a PDF of this information.

CONTACT

Stephanie Del Toro

Director of Development

512.232.0145

[email protected]